Perspectives

July 2024 CommScope’s divestment fuels the rise of Amphenol as a major BSA and DAS contender; it’s all good for open RAN!

Abstract

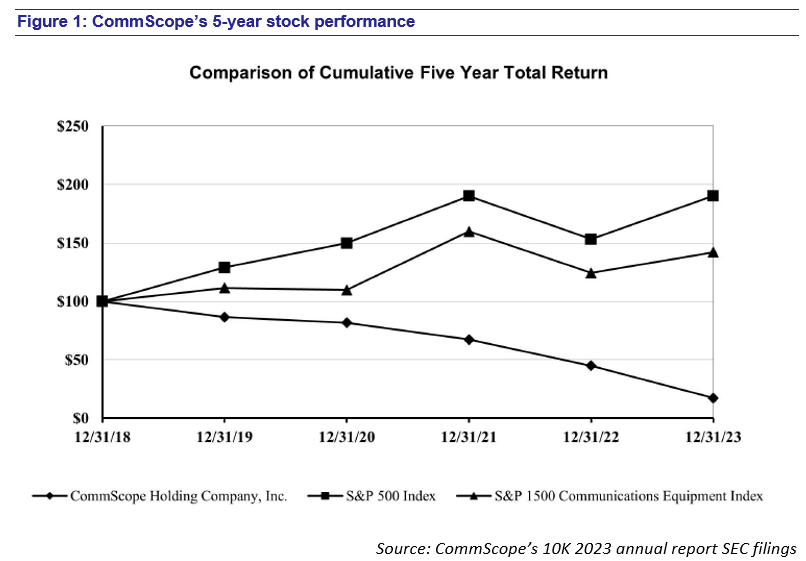

Some people’s misfortune is other people’s fortune! I guess you saw the news, on July 19, 2024, CommScope entered into a definitive agreement to sell its Outdoor Wireless Networks (OWN) segment as well as the Distributed Antenna Systems (DAS) business unit of its Networking, Intelligent Cellular & Security Solutions (NICS) segment to Amphenol Corporation for $2.1B in cash, a super-duper bargain! Given the company’s poor performance (Figure 1) since its stock peaked at $42 on April 1, 2017, and sunk to slightly above $1 in early July 2024, after a brief spike at $22 in July 2021 when 5G was reaching its apex, this divestment conducted as part of the NEXT transformation initiative (launched in 2021) came with little surprise. Case in point, this is what CommScope said in its 10K:

“In 2023, we experienced headwinds related to a slow-down in spending by our customers, but we continue to execute under CommScope NEXT by driving operational efficiencies and focusing on portfolio optimization so that we are in a better position to take advantage of the recovery later in 2024.”

Figure 1 compares cumulative total return on $100 invested on December 31, 2018, in each of CommScope’s common stock, the Standard & Poor’s 500 Stock Index (S&P 500 Index) and the S&P 1500 Communications Equipment Index. The return of the S&P indices is calculated assuming reinvestment of dividends. It’s worth noting that CommScope has not paid any dividends on its common stock over this period.

The complete text of this publication is available to subscribers - please log into your account. If you are not currently subscribed, please contact us for access to this publication.