Perspectives

August 2024 What’s NEXT for Intel’s NEX? Not That Much, Actually!

Abstract

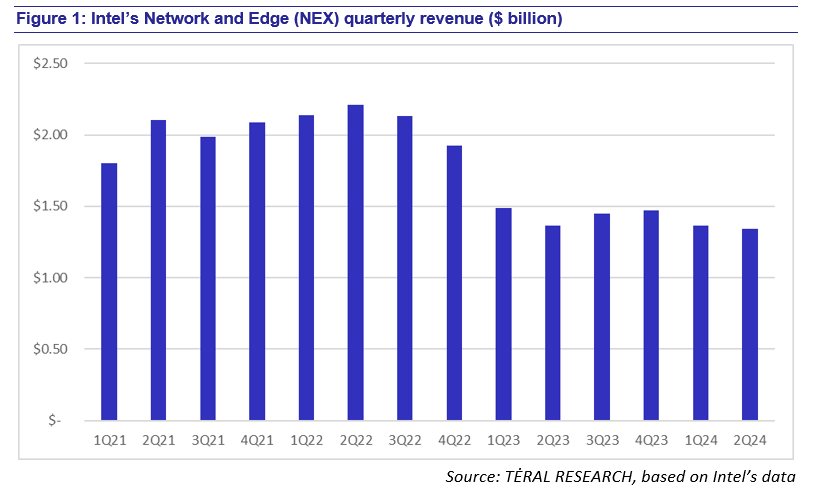

Let’s face it, who cares about Intel’s Network and Edge (NEX) business unit? We, at TĖRAL RESEARCH, do because we track RAN, vRAN, open RAN and open vRAN quarterly and NEX is the business unit where all RAN products sit. The problem is that NEX keeps shrinking and in 2Q24 accounted for 11% of Intel’s total products revenue (Figure 1). In its earnings call on August 1, 2024, while delivering the bad news, including layoffs and capex cuts, Intel CEO Patrick Gelsinger mentioned NEX only 3 times:

- “Turning to NEX, we continue to see stability in Q2, while introducing new products that will expand our leadership in edge and networking into the future.”

- “Specifically, Q3 will be impacted by a modest inventory digestion in CCG, with DCAI and our more cyclical businesses of NEX, Altera and Mobileye trending below our original forecasts.” —Lingering inventory issues?

- “Combined with a growing number of use cases of AI on the edge, NEX is well positioned to be an accretive growth driver in 2025 and beyond.” —Including RAN?

In the 2Q earnings presentation, the following statement was made about NEX’s revenue: “Excluding Telco, 1H’24 NEX revenue and operating margin +10% YoY.” In addition, Intel CFO David Zinsner said that “NEX, obviously, also outside of the telco space is starting to recover.” It sounds very intriguing to us that Intel is not seeing any signs of recovery in the telco space because Ericsson, its largest client at this point, has started to ship open RAN products to AT&T during the quarter.

The complete text of this publication is available to subscribers - please log into your account. If you are not currently subscribed, please contact us for access to this publication.